Money Scripts: Our Deep Rooted Beliefs About Money

In today’s digital age, we have access to plentiful sources of information on how to improve our financial situations. We can easily find articles, videos, and podcasts that provide tips and tricks for building a better financial life. However, despite all of this information, it can still be incredibly difficult to find the right method that works for us. The truth is, money behaviors are incredibly personal and unique to each individual. Our perception of money is shaped by a variety of factors such as upbringing, life experiences, and cultural background. These factors can influence our financial behaviors in ways we might not even be aware of.

That’s why simply reading a ton of finance magazines or following generic financial advice won’t necessarily guarantee you a more positive financial life. Instead, it’s important to understand your own unique money script – the set of beliefs and behaviors that guide your relationship with money. By identifying your money script, you can gain a deeper understanding of your financial behaviors and make more personalized decisions about money.

Dr. Brad Smith, a financial psychologist, introduced the term “money scripts” to categorize financial beliefs that influence our financial habits. Money scripts are beliefs about money that develop early in life and are often passed down from generation to generation. We are often unconscious of it but it is the reason behind our financial outcomes. These categories can help explain why some people are savers, some are spenders, and others avoid money matters altogether. Since these mindsets subconsciously shape our financial behavior since we were really young, you can be challenging to change. However, these scripts are just partial truths for we can never truly place our unique financial habits in one category.

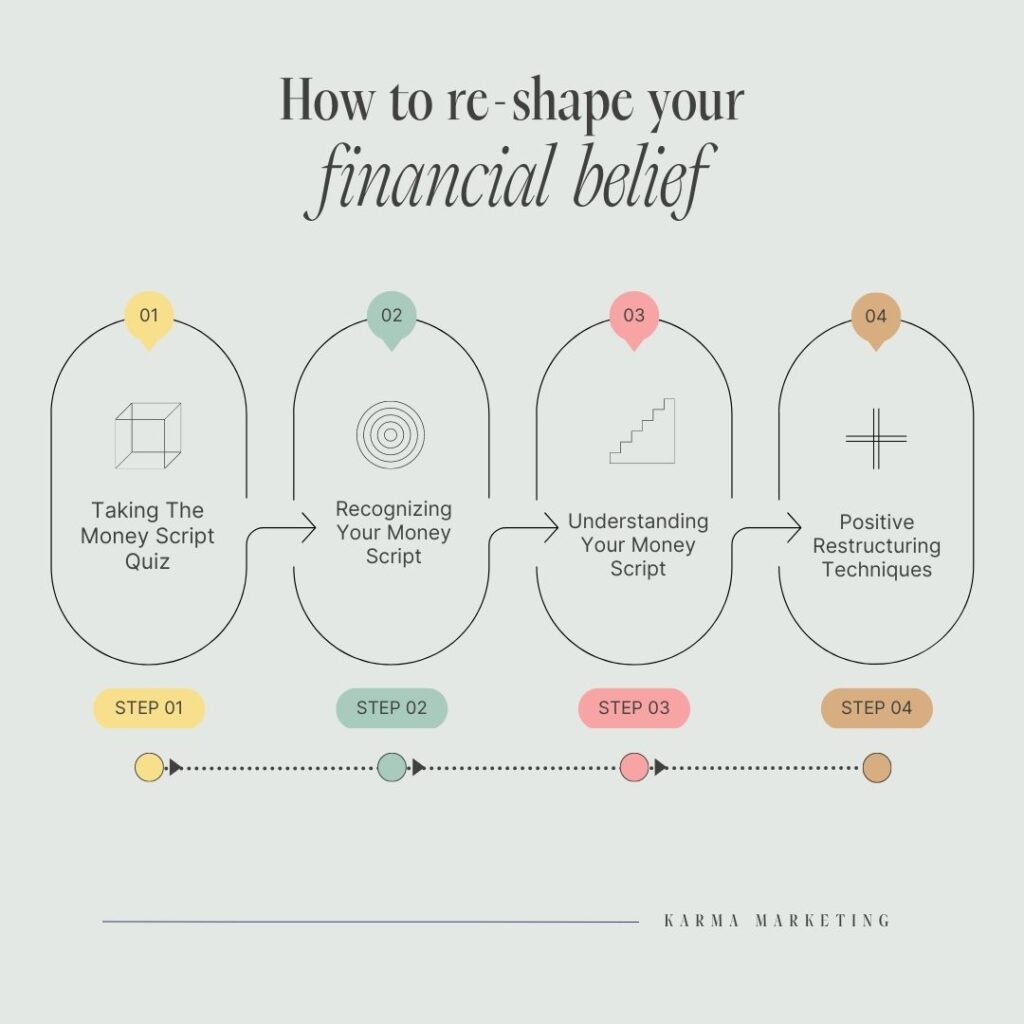

The first step in reshaping your financial beliefs is to identify any negative money beliefs that may be holding you back from achieving your goals. Once you understand the beliefs that are impacting your finances, you can begin to adopt new ways of thinking that support your financial growth.

In this article, we will help you discover your own money script based on your financial behaviors. By doing so, we hope to provide you with personalized tips and strategies that are tailored to your unique relationship with money. Whether you’re looking to pay off debt, build your savings, or invest for the future, understanding your money script is the first step towards achieving your financial goals.

Recognizing Your Money Script

Let’s start with a quiz to help you discover which of the four money scripts best represents your financial behaviors. Note that this is our simplified version of Klontz’s Money Script Test and that you may take the original quiz to get a more accurate result.

As you read through these lists of behavioral patterns of each money script, take a moment to evaluate and choose the one that resonates with you the most. Remember, there are no right or wrong answers – this is simply a tool to help you gain a deeper understanding of your unique relationship with money.

- What is your perception towards money?

a. Money is the root of greed, corruption, and evil

b. Money can solve all problems

c. Money is the proof of a person’s status

d. Money is the result of hard work and frugality

- What do you think money turns people into?

a. Greedy & corrupt

b. Happy & successful

c. Socially elite & high-status

d. Safe & secure

- How do you feel about making financial decisions altogether?

a. I avoid or ignore it

b. It makes me happy and powerful

c. I make sure it lifts my social status

d. Spending money makes me anxious and scared that I won’t have enough left

- How do you feel about investment opportunities?

a. It still has risks, so I avoid it

b. I would do anything for more money

c. I take it because it validates my wealth

d. It makes me feel secure to have a backup plan

- How do you feel about spending money on yourself?

a. Guilty, so I avoid it if it’s not necessary

b. I feel successful and fulfilled in life

c. It elevates me to a higher social status

d. It makes me feel careless, selfish, and anxious about the future

- What is your behavior towards seeking money?

a. I almost never ask for more than what I get, it’s better to give than to receive

b. I constantly seek more opportunities to gain money because it is the solution to all problems

c. It is important for my self-worth

d. It is important for the safety of me and my family

- How do you feel about material possessions?

a. I feel ashamed and guilty of having the privilege to own things

b. It makes me feel happy and want more

c. It validates my self-worth as well as my financial success

d. I feel good owning it if it’s an asset that won’t lose value in the future

Let’s take a deeper dive into your financial behaviors based on your answers on that simple quiz.

If you tend to answer A and find yourself…

- Avoiding or ignoring financial matters altogether

- Procrastinating or delaying important financial decisions

- Living frugally to an extreme degree, to the point of sacrificing necessary expenses

- Avoiding investment opportunities or financial risks altogether

- Feeling shame or guilt about having money, or feeling undeserving of financial success

Your money script is categorized as Money Avoidance

If you tend to answer B and find yourself…

- Prioritizing money and material possessions over other values or priorities

- Engaging in compulsive or impulsive spending habits

- Constantly seeking more money, even when it is not necessary or appropriate

- Believing that money will solve all problems or bring happiness and fulfillment

- Feeling a sense of entitlement or superiority based on financial status

Your money script is categorized as Money Worship

If you tend to answer C and find yourself…

- Associating financial success with personal worth or status

- Feeling pressure to maintain a certain standard of living or level of spending to maintain social status

- Seeking validation or approval from others based on financial success or possessions

- Engaging in conspicuous consumption to display wealth or status to others

- Feeling anxiety or shame when financial status is threatened or challenged

Your money script is categorized as Money Status

If you tend to answer D and find yourself…

- Monitoring finances constantly and excessively

- Feeling anxious or fearful about financial decisions and outcomes

- Having difficulty spending money, even when it is necessary or appropriate

- Hoarding money or engaging in excessive saving behaviors

- Feeling a sense of relief or satisfaction from being financially secure or having a safety net

Your money script is categorized as Money Vigilance

It’s important to note that not all of these behaviors will necessarily apply to you if you have a particular money script. Additionally, the severity and impact of these behaviors can vary depending on your specific situation and individual circumstances.

Understanding Your Money Script

Now that you have a better understanding of your financial beliefs and behaviors, let’s take a deeper look at each of the four money scripts. By exploring the definitions of each script, understanding how you perceive money, and examining the influences that may have shaped these beliefs, we can gain a more comprehensive understanding of our money mindset. So, let’s dive in and discover what your money script really means!

Money Avoidance:

Money avoidance is a belief that money is inherently bad or negative, and therefore should be avoided or ignored. People with this money script believe that wealthy people are greedy, and that money is what makes people selfish. They may feel guilty or anxious about having money or may believe that financial success is morally wrong. This way of thinking makes it hard for them to want money even though they know it could improve their lives.

Money Worship:

Money worship is the idea that money is the most crucial thing in life, and that money is the solution to all problems. People with this money script may believe that they can never have enough money, and may feel a sense of emptiness or dissatisfaction if they are not constantly accumulating wealth. People may start having this belief due to different reasons, including growing up in an environment that values wealth and material possessions or having been through financial instability in their life.

Money Status:

Money status is a belief that a person’s worth or status is based on their financial success or possessions. People with this money script may feel a need to constantly display their wealth or possessions, or may feel ashamed or inferior if they are not able to keep up with others. Consequently, they might pretend to be wealthier than they really are and overspend to give others the impression that they have achieved financial success.

Money Vigilance:

Money vigilance is a belief that money is a result of hard work, discipline, and frugality. This script is considered the most financially stable and healthy one. However, sometimes money vigilance can also indicate a fear of not having enough money in the future, which can lead to anxiety and an unbalanced approach to spending and saving. People with this mindset think that it is important to be constantly vigilant and careful with financial decisions. They may also prefer to keep their finances private and not talk about money matters with others.

Transforming Your Financial Beliefs: Positive Restructuring Techniques

Once you have identified your money script, you can start taking steps to change your beliefs about money. Regardless of which category you fall into, it’s important to recognize where you currently stand to decide where you want to go. You can begin by asking yourself the following questions:

- What can I do to improve my relationship with money?

- How can I balance my spending and saving?

- Do my current financial habits align with my core values?

Answering these questions can help you gain a better understanding of your relationship with money and what changes you need to make to improve your financial well-being. Here are some ways you can use positive restructuring to rewrite your negative money beliefs according to your money script:

- Money Avoiders

Money avoiders perceive money negatively by associating it with negative feelings such as greed, guilt, and shame. You may also believe that money is a source of conflict. This negative perception of money can lead to avoidance of financial planning, difficulties in making financial decisions, and even self-sabotage.

Positive restructuring for money avoidance script can be achieved by acknowledging the benefits of having money. Remember that you have the power to make positive changes when you have financial freedom. Envision the personal goals that you have been wanting to reach, or even the people you can help through charity.

Search for ways for you to become more comfortable with money. You can start small, for example by taking online financial education courses or listening to financial audiobooks. By taking proactive steps towards improving your financial knowledge and skills, you can increase your confidence in dealing with money and overcome your negative beliefs about it.

- Money worshippers

Money worshipers believe that accumulating wealth is the solution to all their problems and that money is the key to happiness. While chasing after wealth as quickly as possible, you may often find yourself feeling unfulfilled and empty, as the constant desire for more money can never truly be satisfied. This is because our wants and needs are constantly changing, and we will never feel like we have “enough” money to meet them.

Positive restructuring for the belief in money worship can be achieved by recognizing that money is just a tool to achieve your goals and that it should not be the center of your attention. Instead, it is better to reframe your beliefs by focusing on the true source of your happiness. What is it that you truly value? Are you really lacking money or is it the abundance mindset you are missing? Finding ways to align your financial goals with your emotional fulfillment is great, but keep in mind that your spirit is the true key to improving your personal growth, relationships, or health. Practice gratitude for what you already have, and find ways to give back to others, so that you can shift your focus from material possessions to a more fulfilling life.

- Money Status

People with a money status belief perceive money negatively by associating it with their status or social standing. You may believe that having money is necessary to be respected, admired, or valued by others. You may also feel that you need to spend money on expensive items or experiences to maintain your status, which can lead to financial strain and debt.

Positive restructuring for the money status mindset can be achieved by being aware that true respect and admiration come from one’s character and actions, rather than material possessions or wealth. It’s important to identify the personal qualities that make you who you are, but aren’t dependent on your material possessions. Before making a purchase, take a moment to evaluate how it fits into your overall vision for your life. Ask yourself if the purchase is a temporary band-aid or a status symbol, or if it will truly enhance your life meaningfully.

Indeed, money is one of the signs of success in life. What you can do to fix your overspending habit is by shifting your financial priorities into ones that will benefit you in the long run. Focus on long-term financial goals like sending your kids to college, building your dream house, up until a joyful retirement. Think of it as securing your social status in the future by saving and investing money instead of spending them excessively for show.

- Money vigilance

People with money vigilance belief are constantly careful with money because they feel that any financial mistake could lead to disaster. The negative behavior that comes with this money script is the tendency to hoard cash or avoid spending it, even when it is necessary or appropriate. So the consequence of being hyper-focused on financial security is that you may forget to enjoy the benefits of money.

The first step of positive restructuring for this mindset is by noting that enjoying life and being present at the moment is just as important as ensuring financial security for the future. Balance is an important aspect of life, and it’s no different when it comes to money. Finding a balance between spending and saving is crucial to achieving financial stability and making the most of your resources. It’s important to strike a balance that makes your efforts worthwhile and motivates you to continue managing your finances effectively.

One way to balance saving money for the future with enjoying your present life is to create a “happiness” bucket in your savings account. This bucket can be used for anything that you enjoy – from staying at a luxury hotel to buying concert tickets. By setting aside money specifically for enjoyable experiences, you can avoid feeling guilty about spending money and instead focus on the positive impact that these experiences can have on your mental health and overall well-being. Remember that while it’s important to save money and be financially responsible, spending money on things that bring you joy and fulfillment can add purpose and meaning to your life.